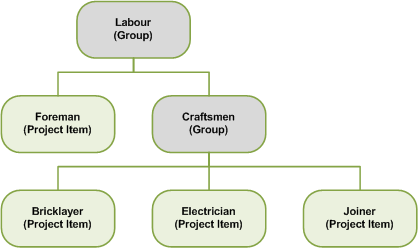

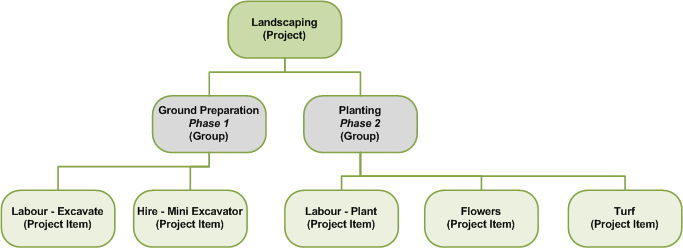

Groups are optional, and are used to group together related items in a logical structure. This allows you to analyse the costs for that group. In the project structure, each group is categorised by its grouping level. Unlike project levels, grouping levels that you define are not unique and may be used across a number of projects.

A project can contain main group activities that are further broken down into actual activities. For example, the project level of exhibition could include groups for venue hire, stand construction and catering. These groups would be used to relate the project items for each activity.

- For information on setting up grouping levels, see Define grouping levels.

- For information on setting up groups, see Set up project items.

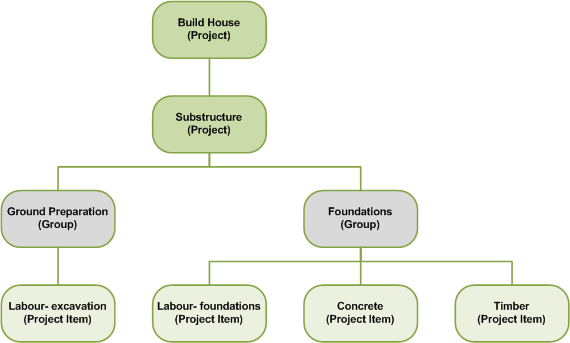

The following grouping structure could be used for a house building project.

To build the substructure of the house, the activities are broken up into two groups of Ground Preparation and Foundations.

The Ground Preparation group contains a single activity of Labour - excavation. The Foundations group contains the activities of Labour - foundations, Concrete and Timber.

The activities are set up as project items in the structure, which you can post costs and revenues against. You do not post costs and revenues against group items, as they are used to group together other activities for analysis purposes. Project Accounting allows you to analyse costs at any level of the structure.