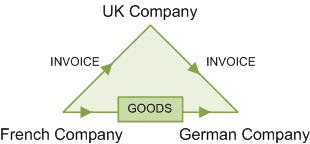

Triangulation is the term used to describe the supply of goods between EC countries that involves three parties.

For example, a UK company receives an order from a customer in Germany. To fulfil the order the UK company purchases the goods from their supplier, based in France. The goods are delivered directly from the French supplier to the German customer.

The invoice for the goods is sent to the German customer from the UK company.

As the goods do not enter the UK, an indicator must be placed on the EC Sales list to show that the sale represents a triangulation transaction.

To mark sales as triangulated on the EC Sales list in Sage 200, you must select the Triangulated checkbox when entering the following types of transaction:

| Module | Type of transaction |

|---|---|

| Sales Ledger |

Invoice Free Text Invoice Credit Note Batch Invoice Batch Credit Note |

| Sales Order Processing |

Sales Order - Full | Delivery and Invoicing Sales Order - Trade | Delivery and Invoicing Repeat Order Template | Delivery and Invoicing Sales Return | Return and Credit Quotation | Delivery and Invoicing Pro forma | Delivery and Invoicing Note: If you have created the sales order using Sage 200 CRM, you must amend the order in Sage 200 and select the Triangulated checkbox from the Delivery and Invoicing tab in the sales order. |