Note: If you are using consolidation, we recommend that you do not enter previous year journal entries. Prior year journal values are consolidated into the current consolidated period and this will distort current year values.

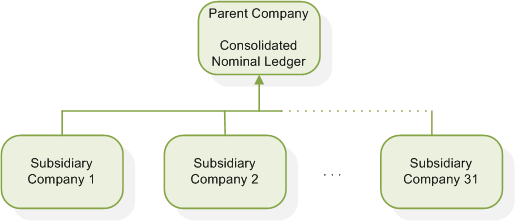

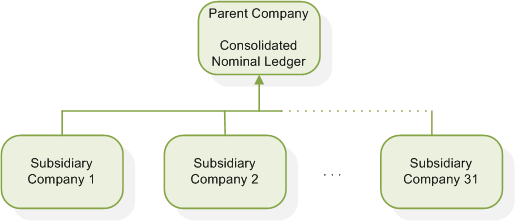

Consolidation is used to combine the nominal ledger account balances of several subsidiary companies into one parent or group company.

This is typically used in large organisations where the subsidiaries are separate trading entities, but management reports need to be produced for the organisation as a whole. There is no limit to the number of subsidiary companies that can be consolidated into a parent company.

When consolidation takes place, the figures in the subsidiary company are posted to the parent company as an imported journal. When this occurs, postings can fail if there is a loss of connection between the parent company and the subsidiary company. If your system crashes while the posting is taking place, then a failed posting transaction will be created and displayed in the Failed Consolidations workspace.

The subsidiary companies can have different base currencies to the parent company. In this scenario, the transactions use the exchange rates set in the parent company when the consolidation takes place.

To consolidate nominal ledgers:

We recommend that you only use the parent company for reporting purposes. This is because you must set all the nominal ledger balances to zero for a new financial year. If you do use the parent company also as a trading company, we recommend that you use Cost Centres.