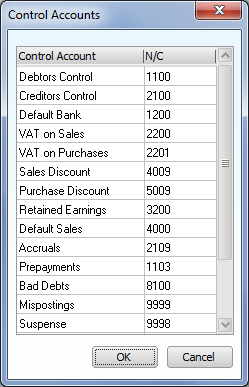

| Debtors Control |

- Records the total amount owed to you by your customers.

- It is updated every time you enter a sales transaction.

- If there are transactions entered on the debtors control account then you can't change it.

- In your profit and loss report, the balance on this account is usually an asset to your business.

|

| Creditors Control |

- Records the total amount you owe your suppliers.

- It is updated every time you enter a purchase transaction.

- If there are transactions entered on the creditors control account then it can't be amended.

- In your Profit and Loss report, the balance on this account is usually a liability to your

business.

|

| Default Bank |

- The bank account that appears by default when recording money in and out of your business. It's normally the bank account you use most frequently.

- You can't delete this account, so at least one bank account is always available for your software and business needs.

|

| VAT on Sales |

- Records the tax payable on sales transactions that are to be included in your

VAT Return. Typically this is the cumulative balance for the VAT quarter.

|

| VAT on Purchases |

- Records the tax you have paid on purchase transactions that are to be dealt with in your next VAT Return. Typically this is the cumulative balance for the VAT quarter.

|

| Sales Discount |

- Records the value of discounts you have given to your customers. This balance reduces your sales profit and therefore your gross profit.

- This account updates when you record a customer receipt which includes a discount.

- The balance on the account clears as part of the year end process.

|

| Purchase Discount |

- Records the value of discounts from your suppliers. This balance reduces your purchase expenses and therefore increases your gross profit.

- This account updates when you record a supplier payment which includes a discount.

- The balance on the account clears as part of the year end process.

|

| Retained Earnings |

- Updates as part of your year end process. It holds the surplus or shortfall in income for the closing financial year.

- During the year end process, the balances from your profit and loss nominal accounts move to this account. This clears those accounts ready to start the new year.

|

| Default Sales |

- Records the net value of sales transactions.

- As a default it should be the account that you want to use most often for posting values when you record an invoice or sales order, unless the customer's record specifies something different.

- The balance on the account clears as part of the year end process.

|

| Accruals |

- The default account for use when recording an accrual. When used for an accrual it records the amount that has been set aside to pay an expense.

- Any account used for accruals updates as part of the month end process until it eventually clears with the total expense value on the final accrual posting.

|

| Prepayments |

- The default account when recording a prepayment. It records the amount that has already been paid for an expense.

|

| Bad Debts |

- Records the amount you have written off as a result of customer bad debt and reduces the balance on your gross profit and loss.

- This account updates when you write off bad customer debt using the Write Off, Refund and Returns wizard.

- The balance on the account clears as part of the year end process.

|

| Mispostings |

- Is used for anomalies found in your accounts. It updates if inconsistencies are found with your data during conversion.

- Contact your accountant if you find a balance on this account - they should be able to advise you which nominal account you should move the balance to. We recommend you do this before you run the year end process.

|

| Suspense |

- Records the opposing credit or debit when an opening balance is added to customer, supplier, nominal and bank records.

|

| Credit Charges |

- Records the credit charges you raise against your customers. The balance increases income and therefore increases profit.

- This account updates when you apply charges using the Credit Charges wizard.

- The balance on the account clears as part of the year end process.

|

| Exchange Rate Variance |

- Records the difference between the exchange rate used when creating an invoice and that used at the point of payment.

- The account updates when such variations are calculated using the Foreign Bank Revaluation wizard.

- The balance on the account clears as part of the year end process.

|

| VAT Liability |

- This is the default account used when you transfer balances from the VAT on sales and VAT on purchases control accounts, this routine is completed at the end of a VAT period. This is the amount of VAT you owe to the tax authorities or the amount you are due as a refund.

- The account also updates with any reconciled manual adjustments that are made to the VAT Return.

|

| Manual Adjustments |

- Records the value of reconciled adjustments made to your last VAT Return. At the same time the value updates to the VAT Liability account where it is classed as pending payment or refund.

|

| CIS Tax Control |

- Only available for those using the Construction Industry Scheme module.

- This account records the value of tax from subcontractors' payments before the money is included on the CIS monthly return (CIS 300).

|

| CIS Tax Liability |

- Only available for those using the Construction Industry Scheme module.

- This account records the value of the tax deductions from subcontracts' payments, once the monies have been included in the CIS monthly return and are ready to be paid to HMRC.

|